from Bloomberg https://bloom.bg/2PBlm6m

Tuesday, April 30, 2019

Tuesday, April 30, 2019

Tuesday, April 30, 2019 Unknown

Unknown HEALTH NEWS

HEALTH NEWS No comments

No comments

from Health http://bit.ly/2ZGfCN6

Tuesday, April 30, 2019

Tuesday, April 30, 2019 Unknown

Unknown TECHNOLOGY NEWS

TECHNOLOGY NEWS No comments

No comments

Samsung’s Q1 earnings are in and, as the company itself predicted, they don’t make for pretty reading.

The Korean giant saw revenue for the three-month period fall by 13 percent year-on-year to 52.4 trillion KRW, around $45 billion. Meanwhile, operating profit for Q1 2019 came in at 6.2 trillion KRW, that’s a whopping $5.33 billion but it represents a decline of huge 60 percent drop from the same period last year. Ouch.

Samsung’s Q1 last year was admittedly a blockbuster quarter, but these are massive declines.

What’s going on?

Samsung said that sales of its new Galaxy S10 smartphone were “solid” but it admitted that its memory chip and display businesses, so often the most lucrative units for the company, didn’t perform well and “weighed down” the company’s results overall. Despite those apparent S10 sales, the mobile division saw income drop “as competition intensified.” Meanwhile, the display business posted a loss “due to decreased demand for flexible displays and increasing market supplies for large displays.”

That’s all about on par with what analysts were expecting following that overly-optimistic Q1 earnings forecast made earlier this month.

The immediate future doesn’t look terribly rosy, too.

Samsung said the overall memory market will likely remain slow in Q2 although DRAM demand is expected to recover somewhat. It isn’t expecting too much to change for its display business, either, although “demand for flexible smartphone OLED panels is expected to rebound” which is where the company plans to place particular focus.

On the consumer side, where most readers know Samsung’s business better, Samsung expects to see improved sales in Q2, where buying is higher. It also teased a new Note, 5G devices — which will likely limited to Korea, we suspect — and that foldable phone.

The Galaxy Fold has been delayed after some journalists found issues with their review units — TechCrunch’s own Brian Heater was fine; he even enjoyed using it. There’s no specific mention in the quarterly report of a new launch date but it looks like the release will be mid-June, that’s assuming what AT&T is telling customers is accurate. But we’ll need to wait a few weeks for that to be confirmed, it seems.

Samsung says it will announce a revised launch date for the Galaxy Fold in the next few weeks.

Executives are speaking on a 1Q earnings conference call.— Tim Culpan (@tculpan) April 30, 2019

from TechCrunch https://tcrn.ch/2vt1Dwv

Tuesday, April 30, 2019

Tuesday, April 30, 2019 Unknown

Unknown TECHNOLOGY NEWS

TECHNOLOGY NEWS No comments

No comments

Southeast Asia’s startup ecosystem is set to get a massive injection of funds after Jungle Ventures reached a first close of $175 million for its newest fund, TechCrunch has come to learn.

Executives at the Singapore-based firm anticipate that the new fund, which is Jungle’s third to date, will reach a final close of $220 million over the coming few months, a source with knowledge of the fund and its plans told TechCrunch. If it were to reach that figure, the fund would become the largest for startup investments in Southeast Asia.

Jungle Ventures declined to comment.

An SEC filing posted in December suggested the firm was aiming to raise up to $200 million with the fund. Its last fund was $100 million and it closed in November 2016. Founding partners Anurag Srivastava and Amit Anand started the fund way back in 2012 when it raised a (much smaller) $10 million debut fund.

Digging a little deeper, our source revealed that the new Jungle fund includes returning LPs World Bank affiliate IFC and Cisco Investments — both of which invested in Jungle’s $18 million early-stage ‘SeedPlus’ fund — and Singapore sovereign fund Temasek. One new backer that we are aware of is German financier DEG although we understand that Jungle has spent considerable time fundraising in the U.S. market, hence the SEC filing. Beyond Europe and the U.S, the firm is also said to have pitched LPs in Asia — as you’d expect — and the Middle East.

Jungle is focused on Series A and Series B deals in Southeast Asia with the occasional investment in India or the rest of the world where it sees global potential. One such example of that is Engineer.ai, which raised $29.5 million last November in a round led by Jungle and Lakestar with participation from SoftBank’s AI unit DeepCore.

Jungle Ventures founding partners (left to right): Anurag Srivastava and Amit Anand

The meat and drink of the fund is Southeast Asia, and past investments there include cloud platform Deskera (most recent round $60 million), budget hotel network Reddoorz (raised $11 million last year), fintech startup Kredivo (raised $30 million last year) and digital fashion brand Pomelo, which has raised over $30 million from investors that also include JD.com.

In India, it has backed b2b sales platform Moglix and interior design startup Livspace among others. Past exits include Travelmob to HomeAway, Zipdial to Twitter, eBus to IMD and Voyagin to Rakuten.

We understand that the new fund has already completed five deals. Jungle’s pace of dealmaking is typically half a dozen investments per year, and we understand that will continue with fund three.

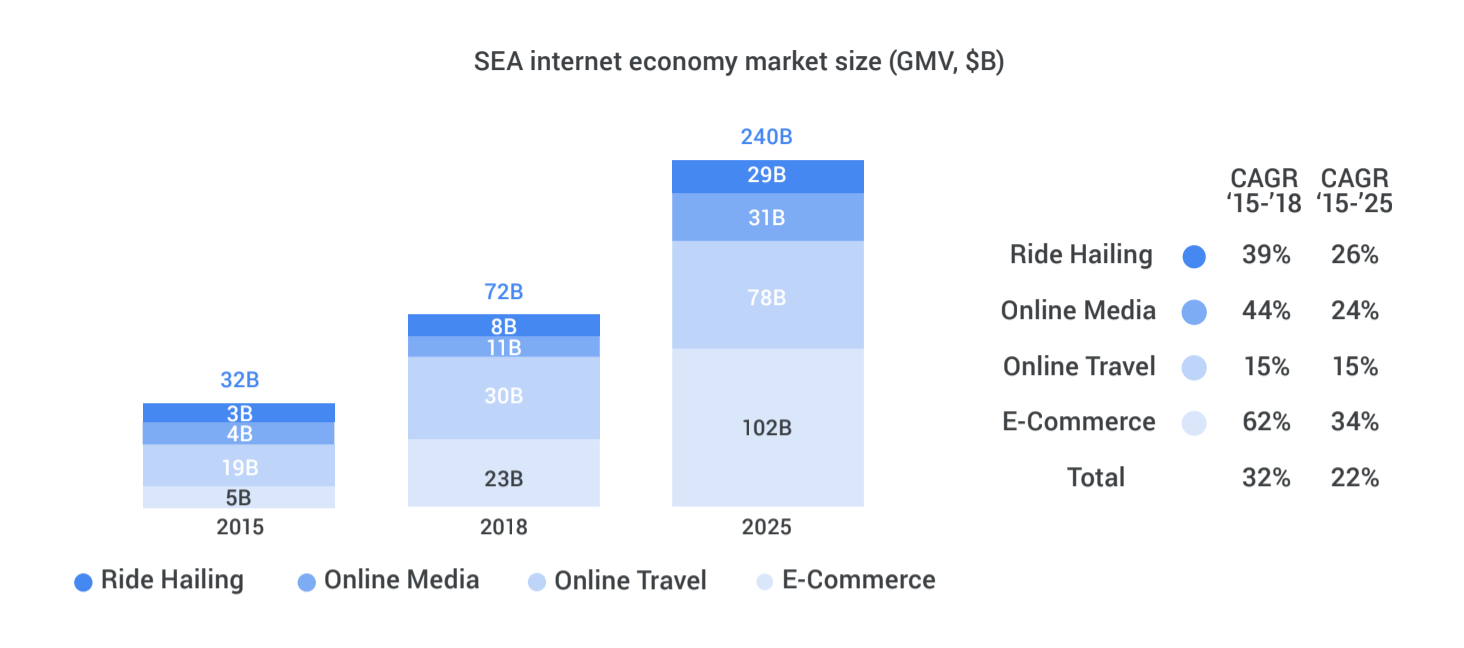

Executives at the fund are bullish on Southeast Asia, which is forecast to see strong growth economic growth thanks to increased internet access and digital spending. A much-cited report from Google and Temasek issued last year predicts that the region’s ‘digital economy’ will triple to reach $240 billion from 2025.

A 2018 report from Temasek and Google predicts significant growth in Southeast Asia’s digital economy

Other major VC funds in Southeast Asia include Vertex Ventures ($210 million fund), Golden Gate Ventures — $100 million and a $200 million growth fund — Openspace Ventures ($135 million), and EV’s $150 million growth fund.

There’s also B Capital from Facebook co-founder Eduardo Saverin which recently passed $400 million for the first close of its second fund, although that doesn’t invest exclusively in Southeast Asia, and Sequoia which has a $695 million fund for India and Southeast Asia. Other global names that you might see cutting deals in the region include Burda, which has a local presence and starts at Series B, TPG Global and KKR.

Update 04/29 19:50 PST: The original version of this article has been updated to correct that Jungle invests in around a dozen companies per year, not per month.

from TechCrunch https://tcrn.ch/2VugbdT

Tuesday, April 30, 2019

Tuesday, April 30, 2019 Unknown

Unknown TECHNOLOGY NEWS

TECHNOLOGY NEWS No comments

No comments

Alphabet’s Q1 earnings were a disappointment for Wall Street, courtesy primarily of ad revenue shortcomings. The hardware team met with some difficulties, as well, owing in part to a stagnating global smartphone market that has impacted virtually all players.

CEO Sundar Pichai cited “year over year headwinds” when referring to the company’s smartphone line, following the release of the Pixel 3 and Pixel 3 XL last fall. The executive rightly referenced the company’s relatively recent entry as a standalone hardware developer and painted a hopeful picture of the industry’s innovations going forward.

“I do continue to be excited to see 5G coming and the early foldable phones, which Android plays a big part in driving,” Pichai said on the call. Google has notably taken an important role developing an Android UI designed for the foldable form factor, along with working closely beside Samsung on its recently delayed foldable.

CFO Ruth Porat echoed Pichai’s comments, while hinting at what’s to come from the company. “While the first quarter results reflect pressure in the premium smartphone industry,” the exec explained, “we are pleased with the ongoing momentum of Assistant-enabled Home devices, particularly the Home Hub and Mini devices and look forward to our May 7 announcement at I/O from our hardware team.”

The reference to “premium smartphone[s]” looks to be a roundabout confirmation of the rumored Pixel 3a. The mid-tier take on the Pixel line is rumored to be a rare I/O hardware debut, coming next month. The arrival of such a device could go a ways toward helping jumpstart slowing sales for the line.

Pichai referenced the company’s newly opened “campus and engineering hub.” A result of the company’s massive deal with struggling handset maker, HTC, the Taipei R&D center will be primarily focused on Google’s smartphone offerings. He also referenced the company’s Amazon-competing Home line as a bright spot for its hardware offerings, particularly the Mini and Hub.

“If you take products like Google Home and Assistant products, we’ve been doing really well,” said Pichai. “We see strong momentum. We’re market leaders in the category, especially when you look at it on a global basis.”

from TechCrunch https://tcrn.ch/2vt6Owk

Tuesday, April 30, 2019

Tuesday, April 30, 2019 Unknown

Unknown TECHNOLOGY NEWS

TECHNOLOGY NEWS No comments

No comments

We’re deep in IPO news, and last week was no different. When this happens, Equity’s Kate Clark and Alex Wilhelm fire up their mics and wax financial about the news we can’t possibly fit into the regular episode of the popular TechCrunch podcast.

Last week the duo discussed Uber’s IPO pricing and Slack’s S-1.

On Uber:

Kate: And before we jump into Uber’s Q1 financials, what do you think of Uber is most recent private valuation of 72 billion. Do you think that’s a wildly inflated valuation or do you think that’s a reasonable price tag?

Alex: So I have absolutely no idea. And we’re going to get into this a bit with the Q1 numbers, but I don’t know how to price this company. I really don’t. We talk a lot about SaaS IPOs and there’s a lot of really solid metrics out there about those companies and what they’re worth and what makes them work more or less than competitors. Uber’s a strange beast. It’s got these enormous losses. It’s got slowing growth. It is a global brand. It’s got an enormous amount of revenue. But where to put a price on it for me is a really big struggle. And this is why I’m glad that I’m a journalist and not an analyst because I don’t have to make that call.

On Slack:

Kate: I thought they were closer to profitability than they actually are and Slack is still losing a lot of money. So really it’s just like all the other unicorns who you’ve been covering who are not profitable and who are losing a lot of money, but Slack is a great business. So I think we’re going to see that play out. Actually. I kind of wish it was doing an IPO because it’s a lot more fun to speculate and criticize when we’re covering, direct listings yeah, they are so simple in so many ways and I think that’s what has appealed Spotify and Slack to that method of exit just because it does cut out a lot of that kind of especially unnecessary prices those companies have to pay, you save a lot of money doing it this way.

For access to the full transcription, become a member of Extra Crunch. Learn more and try it for free.

from TechCrunch https://tcrn.ch/2V4vTgg

Tuesday, April 30, 2019

Tuesday, April 30, 2019 Unknown

Unknown TECHNOLOGY NEWS

TECHNOLOGY NEWS No comments

No comments

Twitter is unveiling a number of new content deals and renewals tonight at its NewFronts event for digital advertisers.

It’s only been two years since Twitter first joined the NewFronts. At the time, coverage suggested that executives saw the company’s video strategy as a crucial part of turning things around, but since then, the spotlight has moved on to other things (like rethinking the fundamental social dynamics of the service).

And yet the company is still making video deals, with 13 of them being unveiled tonight. That’s a lot of announcements, though considerably less than the 30 revealed at last year’s event. The company notes that it has already announced a number of partnerships this year, including one with the NBA.

“When you collaborate with the top publishers in the world, you can develop incredibly innovative ways to elevate premium content and bring new dimensions to the conversations that are already happening on Twitter,” said Twitter Global VP and Head of Content Partnerships Kay Madati in a statement. “Together with our partners, we developed this new slate of programming specifically for our audiences, and designed the content to fuel even more robust conversation on Twitter.”

Here’s a quick rundown of all the news:

- A partnership with Univision covering Spanish-language sports, news and entertainment content, including 2020 election analysis and reporting.

- A multi-year extension of Twitter’s deal with the NFL, which includes highlights and analysis.

- The Players’ Tribune and Twitter are announcing a live talk show called “Don’t @ Me,” where two athletes with debate topics chosen in part by Twitter users.

- A multi-year extension of Twitter’s deal with Major League Soccer.

- Continued programming from ESPN, including new ESPN Onsite branding to highlight shows filmed on location at big events.

- Bleacher Report is bringing “House of Highlights” back for a second season.

- Blizzard Entertainment will be sharing content from BlizzCon in November, including the entire opening ceremony.

- The Wall Street Journal is launching WSJ What’s Now, an original video show for Twitter. The deal will also include live-streamed content from Wall Street Journal events.

- Bloomberg’s TicToc will expand its coverage to include events like the G20 Summit, United Nations General Assembly and World Economic Forum.

- CNET is announcing a new partnership with Twitter, which will cover major tech industry events.

- Time is developing new video content for Twitter around the Time Person of the Year and Time 100.

- Live Nation is bringing a new concert series exclusively to Twitter this fall, with 10 concerts in 10 weeks.

- At the Video Music Awards, Viacom-owned MTV will offer a Stan Cam where fans can share their own live-streamed reactions to the show. Viacom will also be live-streaming red carpet coverage from its other events.

from TechCrunch https://tcrn.ch/2PE434z

Tuesday, April 30, 2019

Tuesday, April 30, 2019 Unknown

Unknown TECHNOLOGY NEWS

TECHNOLOGY NEWS No comments

No comments

Amazon announced today it has begun to ask customers to participate in a preview program that will help the company build a Spanish-language Alexa experience for U.S. users. The program, which is currently invite-only, will allow Amazon to incorporate into the U.S. Spanish-language experience a better understanding of things like word choice and local humor, as it has done with prior language launches in other regions. In addition, developers have been invited to begin building Spanish-language skills, also starting today, using the Alexa Skills Kit.

The latter was announced on the Alexa blog, noting that any skills created now will be made available to the customers in the preview program for the time being. They’ll then roll out to all customers when Alexa launches in the U.S. with Spanish-language support later this year.

Manufacturers who want to build “Alexa Built-in” products for Spanish-speaking customers can also now request early access to a related Alexa Voice Services (AVS) developer preview. Amazon says that Bose, Facebook and Sony are preparing to do so, while smart home device makers, including Philips, TP Link and Honeywell Home, will bring to U.S. users “Works with Alexa” devices that support Spanish.

Ahead of today, Alexa had supported Spanish language skills, but only in Spain and Mexico — not in the U.S. Those developers can opt to extend their existing skills to U.S. customers, Amazon says.

In addition to Spanish, developers have also been able to create skills in English in the U.S., U.K., Canada, Australia, and India; as well as in German, Japanese, French (in France and in Canada), and Portuguese (in Brazil). But on the language front, Google has had a decided advantage thanks to its work with Google Voice Search and Google Translate over the years.

Last summer, Google Home rolled out support for Spanish, in addition to launching the device in Spain and Mexico.

Amazon also trails Apple in terms of support for Spanish in the U.S., as Apple added support for Spanish to the HomePod in the U.S., Spain and Mexico in September 2018.

Spanish is a widely spoken language in the U.S. According to a 2015 report by Instituto Cervantes, the United States has the second highest concentration of Spanish speakers in the world, following Mexico. At the time of the report, there were 53 million people who spoke Spanish in the U.S. — a figure that included 41 million native Spanish speakers, and approximately 11.6 million bilingual Spanish speakers.

from TechCrunch https://tcrn.ch/2vv8Lse

Tuesday, April 30, 2019

Tuesday, April 30, 2019 Unknown

Unknown TECHNOLOGY NEWS

TECHNOLOGY NEWS No comments

No comments

At the Open Infrastructure Summit, which was previously known as the OpenStack Summit, Canonical founder Mark Shuttleworth used his keynote to talk about the state of open-source foundations — and what often feels like the increasing competition between them. “I know for a fact that nobody asked to replace dueling vendors with dueling foundations,” he said. “Nobody asked for that.”

He then put a point on this, saying, “what’s the difference between a vendor that only promotes the ideas that are in its own interest and a foundation that does the same thing. Or worse, a foundation that will only represent projects that it’s paid to represent.”

Somewhat uncharacteristically, Shuttleworth didn’t say which foundations he was talking about, but since there are really only two foundations that fit the bill here, it’s pretty clear that he was talking about the OpenStack Foundation and the Linux Foundation — and maybe more precisely the Cloud Native Computing Foundation, the home of the incredibly popular Kubernetes project.

It turns out, that’s only part of his misgivings about the current state of open-source foundations, though. I sat down with Shuttleworth after his keynote to discuss his comments, as well as Canonical’s announcements around open infrastructure.

One thing that’s worth noting at the outset is that the OpenStack Foundation is using this event to highlight that fact that it has now brought in more new open infrastructure projects outside of the core OpenStack software, with two of them graduating from their pilot phase. Shuttleworth, who has made big bets on OpenStack in the past and is seeing a lot of interest from customers, is not a fan. Canonical, it’s worth noting, is also a major sponsor of the OpenStack Foundation. He, however, believes, the foundation should focus on the core OpenStack project.

“We’re busy deploying 27 OpenStack clouds — that’s more than double the run rate last year,” he said. “OpenStack is important. It’s very complicated and hard. And a lot of our focus has been on making it simpler and cleaner, despite the efforts of those around us in this community. But I believe in it. I think that if you need large-scale, multi-tenant virtualization infrastructure, it’s the best game in town. But it has problems. It needs focus. I’m super committed to that. And I worry about people losing their focus because something newer and shinier has shown up.”

To clarify that, I asked him if he essentially believes that the OpenStack Foundation is making a mistake by trying to be all things infrastructure. “Yes, absolutely,” he said. “At the end of the day, I think there are some projects that this community is famous for. They need focus, they need attention, right? It’s very hard to argue that they will get focus and attention when you’re launching a ton of other things that nobody’s ever heard of, right? Why are you launching those things? Who is behind those decisions? Is it a money question as well? Those are all fair questions to ask.”

He doesn’t believe all of the blame should fall on the Foundation leadership, though. “I think these guys are trying really hard. I think the common characterization that it was hapless isn’t helpful and isn’t accurate. We’re trying to figure stuff out.” Shuttleworth indeed doesn’t believe the leadership is hapless, something he stressed, but he clearly isn’t all that happy with the current path the OpenStack Foundation is on either.

The Foundation, of course, doesn’t agree. As OpenStack Foundation COO Mark Collier told me, the organization remains as committed to OpenStack as ever. “The Foundation, the board, the community, the staff — we’ve never been more committed to OpenStack,” he said. “If you look at the state of OpenStack, it’s one of the top-three most active open-source projects in the world right now […] There’s no wavering in our commitment to OpenStack.” He also noted that the other projects that are now part of the foundation are the kind of software that is helpful to OpenStack users. “These are efforts which are good for OpenStack,” he said. In addition, he stressed that the process of opening up the Foundation has been going on for more than two years, with the vast majority of the community (roughly 97 percent) voting in favor.

OpenStack board member Allison Randal echoed this. “Over the past few years, and a long series of strategic conversations, we realized that OpenStack doesn’t exist in a vacuum. OpenStack’s success depends on the success of a whole network of other open-source projects, including Linux distributions and dependencies like Python and hypervisors, but also on the success of other open infrastructure projects which our users are deploying together. The OpenStack community has learned a few things about successful open collaboration over the years, and we hope that sharing those lessons and offering a little support can help other open infrastructure projects succeed too. The rising tide of open source lifts all boats.”

As far as open-source foundations in general, he surely also doesn’t believe that it’s a good thing to have numerous foundations compete over projects. He argues that we’re still trying to figure out the role of open-source foundations and that we’re currently in a slightly awkward position because we’re still trying to determine how to best organize these foundations. “Open source in society is really interesting. And how we organize that in society is really interesting,” he said. “How we lead that, how we organize that is really interesting and there will be steps forward and steps backward. Foundations tweeting angrily at each other is not very presidential.”

He also challenged the notion that if you just put a project into a foundation, “everything gets better.” That’s too simplistic, he argues, because so much depends on the leadership of the foundation and how they define being open. “When you see foundations as nonprofit entities effectively arguing over who controls the more important toys, I don’t think that’s serving users.”

When I asked him whether he thinks some foundations are doing a better job than others, he essentially declined to comment. But he did say that he thinks the Linux Foundation is doing a good job with Linux, in large parts because it employs Linus Torvalds. “I think the technical leadership of a complex project that serves the needs of many organizations is best served that way and something that the OpenStack Foundation could learn from the Linux Foundation. I’d be much happier with my membership fees actually paying for thoughtful, independent leadership of the complexity of OpenStack rather than the sort of bizarre bun fights and stuffed ballots that we see today. For all the kumbaya, it flatly doesn’t work.” He believes that projects should have independent leaders who can make long-term plans. “Linus’ finger is a damn useful tool and it’s hard when everybody tries to get reelected. It’s easy to get outraged at Linus, but he’s doing a fucking good job, right?”

OpenStack, he believes, often lacks that kind of decisiveness because it tries to please everybody and attract more sponsors. “That’s perhaps the root cause,” he said, and it leads to too much “behind-the-scenes puppet mastering.”

In addition to our talk about foundations, Shuttleworth also noted that he believes the company is still on the path to an IPO. He’s obviously not committing to a time frame, but after a year of resetting in 2018, he argues that Canonical’s business is looking up. “We want to be north of $200 million in revenue and a decent growth rate and the right set of stories around the data center, around public cloud and IoT.” First, though, Canonical will do a growth equity round.

from TechCrunch https://tcrn.ch/2UQZxAw

Tuesday, April 30, 2019

Tuesday, April 30, 2019 Unknown

Unknown TECHNOLOGY NEWS

TECHNOLOGY NEWS No comments

No comments

With news that the We Company (formerly known as WeWork) has officially filed to go public confidentially with the SEC today, there’s a big question on everyone’s mind: Is this the next massive startup win or a house of cards waiting to be toppled by the glare of the public markets?

No company I follow has as much polarized opinion as the We Company. And while the company will have to reveal at least some of its hand in its official S-1, my guess is that the polarization around the company will not be alleviated until well after it goes public, if ever.

The challenge with understanding its business is how much the details of each of its leases, real estate markets and tenants matter to its bottom line. We already know the top line numbers: the company had revenue of $1.8 billion in 2018, and a net loss of $1.9 billion that year. That led to the received opinion that the company has an extraordinarily weak business. As Crunchbase News editor Alex Wilhelm put it:

from TechCrunch https://tcrn.ch/2DE58EK